|

| Image from hk.asia-city.com |

|

| Image from amazon.com |

There are many reasons for his success, his long waist-length straight hair, his fashionable look, the sharpness and directness of his criticism, the fluent hyper-speed recitation of the Ba-zhi diagnoses, etc., but his quirk cannot sustain his fame if he is not truthful enough.

And his most truthful quote, is "the highest level of feng shui, is random guessing."

Sounds very demeaning to the great Chinese system, but his words are absolutely true.

Feng shui, as he often says, is statistics, is a collection of statistical knowledge (though impressionised rather than hard number facts) through thousands of years of observations in the human behaviour in relation to the geography of the surroundings in China. Hence feng shui can affect people's living conditions in certain good or bad ways in general, but there are always exceptions.

See what Dr. House has to say about the feng shui of his office (Season 8 Episode 5).

Surprised that westerners care about feng shui too? You'll be even more surprised after Googling English books on feng shui.

Back to my previous point, what Dr. House felt was really no joke. Feng shui is a lot about comfortability.

|

| A Ceiling Beam Image from idyllwild |

|

| Scared by one's own reflection in the mirror Image from moviesblog.mtv |

This, to me, actually makes sense.

|

| Computer and monitor near the bed Image from seemslegit |

"Feng shui isn't foolproof".

|

| Power Transmission Tower Image from made-in-china |

"Anything regarding Gods and Demons, I have zero idea!

Feng shui is statistics, not religious studies." -- Master Peter So.

Here's an article which demonstrates his firm belief in statistics.

Feng shui masters hit the investment trail

By Li Tao (China Daily)

|

After reading the above article, I did some research myself. I found this article dated Dec 3rd, 2008, and it shows a chart and 2 tables.

|

| Image from fundsupermart |

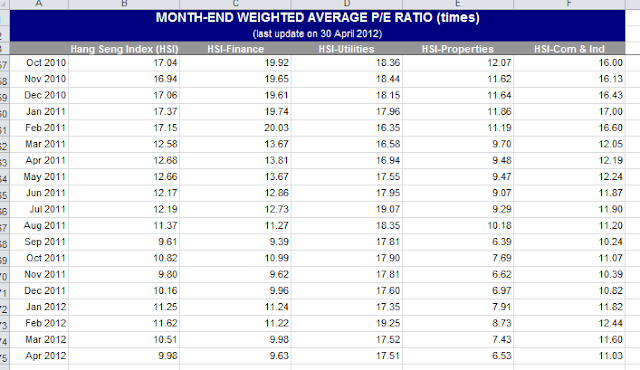

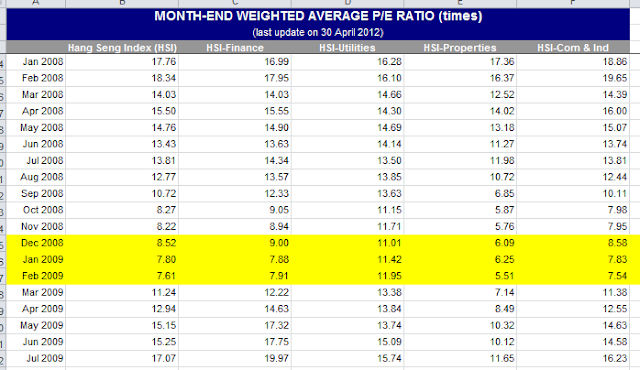

From the above chart, and the table below obtained from Hang Seng Indexes,

|

| Month-end weighted average P/E Ratio (Table 1) Image from hsi.com.hk |

|

| Image from fundsupermart |

|

| Image from fundsupermart |

|

| Month-end weighted average P/E Ratio (Table 2) Image from hsi.com.hk |

Since 1973 till today,

|

| Image from Locky's English Playground |

- January and March each have 7 times being the lowest PE month, while other months are quite even, this could mean January and March are likely to be the best time to buy stocks in Hong Kong.

- At the same time, December has 12 times being the highest PE month, followed by February with 8 times, then January and July with 5 times, meaning that these months are likely to be the months at which the stocks in Hong Kong are the most expensive.

But the questions are,

- How do I know which January is the highest PE or the lowest PE month?

- Should I buy in January and then sell in February?

These are questions which need more analysis to be done, after I have found out, it will be my feng shui.

More on that later.

Please "Like" this entry and the English Playground if you want more of this kind.

Vocabulary:

recitation -- (n) [C] saying a piece of writing aloud from memory

quirk -- (n) [C] an unusual part of someone's personality or habit, or something that is strange and unexpected

fame -- (n) [U] when you are known or recognized by many people because of your achievements, skills, etc

demeaning -- (adj) causing someone to become or feel less respected

comfortability -- (n) [U] how comfortable one's is about something or someone

ceiling beam -- (n)[C] A beam is a horizontal structural element that is capable of withstanding load primarily by resisting bending.

power transmission tower -- (n) [C] a tall structure, usually a steel lattice tower, used to support an overhead power line.

foretell -- (vb) [T] (foretold, foretold) literary to state what is going to happen in the future

tumble -- (vb)[I] to fall a lot in value in a short time

slump -- (vb) [I] (of prices, values or sales) to fall suddenly

breakout -- (n) [C] a violent escape, especially by a group, from prison

bottom out-- (phrasal verb) to have reached the lowest point in a continuously changing situation and to be about to improve

eschew -- (vb) [T] formal to avoid something intentionally, or to give something up

lucrative -- (adj) (especially of a business, job or activity) producing a lot of money

differentiate -- (vb) [I or T] to show or find the difference between things which are compared

mercurial -- (adj) changing suddenly and often

aesthetics -- (US also esthetics) (n)[U] the formal study of art, especially in relation to the idea of beauty

cynic -- (n) [C] disapproving a person who believes that people are only interested in themselves and are not sincere

plausibility -- (n)[U] seeming likely to be true, or able to be believed

Resources:

Feng shui masters hit the investment trail @China Daily

http://www.chinadaily.com.cn/bizchina/2010-02/22/content_9483738.htm

Transmission Tower @ Wikipedia

http://en.wikipedia.org/wiki/Transmission_tower

Feng Shui @ Wikipedia

http://en.wikipedia.org/wiki/Feng_shui

House MD - "Feng Shui" @ YouTube

http://www.youtube.com/watch?v=cyKp9QgapIg

Hong Kong Market At Huge Discount! @ fundsupermart.com

http://www.fundsupermart.com.hk/hk/main/research/viewHTML.tpl?lang=en&articleNo=3104

Peter So Man-fung @ HK Asia City

http://hk.asia-city.com/events/article/peter-so-man-fung-renowned-fortune-teller

Master SoTurning the wheel of fortune @ CUHK

http://www.com.cuhk.edu.hk/varsity/0012/people/masterso.htm

@ Master So Classroom

http://masterso.com/classroom/classroom4_02.php

http://v.youku.com/v_show/id_XMTE2MDgzMzI=.html

Hang Seng Indexes

http://www.hsi.com.hk/HSI-Net/HSI-Net

http://dictionary.cambridge.org/dictionary/british/recitation?q=recitation+

http://dictionary.cambridge.org/dictionary/british/quirk?q=quirk

http://dictionary.cambridge.org/dictionary/british/fame?q=fame+

http://dictionary.cambridge.org/dictionary/british/demeaning?q=demeaning+

http://en.wikipedia.org/wiki/Beam_(structure)

http://en.wikipedia.org/wiki/Power_transmission_tower

http://dictionary.cambridge.org/dictionary/british/foretell?q=foretell+

http://dictionary.cambridge.org/dictionary/british/tumble_1?q=tumble

http://dictionary.cambridge.org/dictionary/british/slump_1?q=slump+

http://dictionary.cambridge.org/dictionary/british/breakout?q=breakout

http://dictionary.cambridge.org/dictionary/british/bottom-out?q=bottoming#bottom-out__2

http://dictionary.cambridge.org/dictionary/british/eschew?q=eschew+

http://dictionary.cambridge.org/dictionary/british/lucrative?q=lucrative+

http://dictionary.cambridge.org/dictionary/british/differentiate_1?q=differentiate+

http://dictionary.cambridge.org/dictionary/british/aesthetics?q=aesthetics+

http://dictionary.cambridge.org/dictionary/british/cynic?q=cynics+#cynic__3

http://dictionary.cambridge.org/dictionary/british/plausible?q=plausibility+

No comments:

Post a Comment